VANCOUVER, BC, July 14, 2023 /CNW/ - MANTARO PRECIOUS METALS CORP. (TSXV: MNTR) (OTCQB: MSLVF) (FSE: 9TZ) ("Mantaro" or the "Company") is pleased to announce a Mineral Resource Estimate ("Mineral Resource Estimate") for its Golden Hill Property ("Golden Hill"), Bolivia. The Mineral Resource Estimate was prepared by P&E Mining Consultants Inc. ("P&E") on behalf of the Company.

- Inferred Mineral Resource Estimate of 857,000 tonnes at 4.4 g/t gold for 121,000 ounces of gold at a 1.5 g/t gold cut-off.

- Estimate is based on 14 diamond drill holes totaling 2,405m equivalent to an Inferred Mineral Resource of 50.21 ounces of gold for every metre drilled.

- Mineral Resource Estimate covers a strike length of only 400 m from surface to a vertical depth generally less than 90 m — a small portion of the exploration footprint of Golden Hill.

- Significant exploration potential at depth and across over +6 km of untested vein swarms at Golden Hill.

- As a permitted mining concession, the Company has mining and development optionality and is planning to commence a Preliminary Economic Assessment.

Darren Hazelwood, Chief Executive Officer of the Company, states "We are incredibly pleased to have defined a maiden high-grade gold Mineral Resource Estimate at Golden Hill. Since optioning Golden Hill in August 2021, our technical team completed a very successful diamond drill program, received excellent recovery results from metallurgical testwork and carried out a petrographic study confirming high-grade primary gold deposition that is not a result of supergene enrichment. The Mineral Resource Estimate is open in all directions and represents an important first benchmark that allows Mantaro shareholders and other stakeholders to realize the current production potential and exceptional exploration upside of Golden Hill."

Gold mineralization at Golden Hill is of an orogenic or greenstone-hosted style. This style of mineralization has been a major source of the world's gold production over the last 100+ years as illustrated by prolific production from such deposits in the Abitibi of Canada, the West Africa Shield and Western Australia. A common theme links orogenic deposits: multiple large deposits form along crustal-scale to regionally extensive gold mineralized structures. Individual deposits typically comprise multiple high-grade shoots within a lower grade gold mineralized envelope, that extend over several kilometres of strike to depths that often exceed +1000 metres.

Mantaro completed 3,010 m of angled diamond drilling, of which 14 drill holes totaling 2,405 m focused on the near surface depth extension of mineralization in La Escarcha open pit to depths of generally less than 90 vertical metres. The maiden Mineral Resource Estimate is hosted within several closely-spaced, sub-vertical to vertical, gold-mineralized shear zones with true widths of up to 13 m.

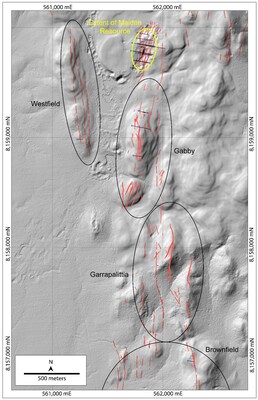

Mineralization at La Escarcha is open in all directions and Mantaro has a number of high reward relatively shallow step-back and step-out drill holes around the Mineral Resource Estimate. The deep potential at La Escarcha is also highly prospective, there are multiple quartz vein targets hosted along the main controlling structure that are yet to be drill tested, and an additional 6 kilometres of the regional structure shedding alluvial gold that is yet to be mapped and sampled.

Dr. Christopher Wilson, Ph.D., FAusIMM (CP), FSEG, FGS, principal consultant to the Company comments, "That Mantaro was able to define a maiden Mineral Resource Estimate after only 2,405 m of angled diamond drilling, is a testament to the technical teams understanding of the mineralized system and deposit, their ability to generate high reward near-surface drill targets and the exceptional caliber of the deposit — all of which contributed to the maiden drill success. Significantly, with true widths of up to 13 m and near surface nature of sub-vertical to vertical mineralized lodes, demonstrated metallurgy, and the fact that Golden Hill is a permitted mining concession with immediate optionality — underscores that the Mineral Resource Estimate is based on a robust cut-off grade of 1.5 g/t Au. It is also worth noting that at a higher cut-off of 2.0 g/t Au, the inferred mineral resource estimate only decreases by approximately 4000 ounces to 117,000 at 4.71 g/t Au, further underscoring the robust nature of the mineral resource estimate and style of mineralization at La Escarcha."

Table 1: Mineral Resource Estimate Summary

Cut-Off | Resource Category | Tonnes | Grade | Ounces |

2.00 | Inferred | 771,000 | 4.71 | 117,000 |

1.90 | Inferred | 783,000 | 4.66 | 117,000 |

1.80 | Inferred | 795,000 | 4.62 | 118,000 |

1.70 | Inferred | 808,000 | 4.58 | 119,000 |

1.60 | Inferred | 827,000 | 4.51 | 120,000 |

1.50 | Inferred(1-5) | 857,000 | 4.40 | 121,000 |

1.40 | Inferred | 891,000 | 4.29 | 122,000 |

1.30 | Inferred | 985,000 | 4.01 | 127,000 |

1.20 | Inferred | 1,061,000 | 3.81 | 130,000 |

Notes: | |

(1) | Mineral Resources, which are not Mineral Reserves, do not have demonstrated economic viability. |

(2) | The estimate of Mineral Resources may be materially affected by environmental permitting, legal title, taxation, socio- |

(3) | Resources are classified according to Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Definition |

(4) | The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral |

(5) | The Inferred Mineral Resource Estimate uses a cut-off of 1.5 g/t gold based on US$1,800/oz Au, 95% process recovery |

The Company will file the National Instrument 43-101 Technical Report that supports the disclosure of the Mineral Resource Estimate within 45 days of this news release.

The Golden Hill property is a fully permitted 5,976 hectare mining concession. Gold mineralization is of an orogenic or greenstone-hosted type, controlled by a regional structure that hosts at least six other gold deposits along a 25 km strike length, which have all been mined by open pit to shallow levels.

Since the Company's option of Golden Hill in August 2021, it has acquired remote sensing data as a foundation for geological and structural mapping, completed a focused geochemical sampling program for input into drill targeting, collected a 10 tonne underground bulk sample for metallurgical testing, and completed a detailed petrographic study to assist with deposit modelling, drill targeting and input to process metallurgy.

As the initial step, the Company took a 10 tonne bulk sample from the -45 m level of the C3 vein at La Escarcha providing a 170 kg sub-sample which was sent to SGS Lakefield (Canada) for metallurgical testwork. Testwork confirmed a head grade of 5.53 g/t gold by 50 g fire assay and 5.96 g/t gold by cyanide leach bottle roll, and demonstrated that unoptimized recoveries of 73.6 % gold are achievable by gravity separation and 94 % gold by cyanidation. These results provided insight into gold grade and distribution at La Escarcha ahead of the maiden diamond drill program. See news release dated December 2, 2021 for complete results from of the metallurgical testwork.

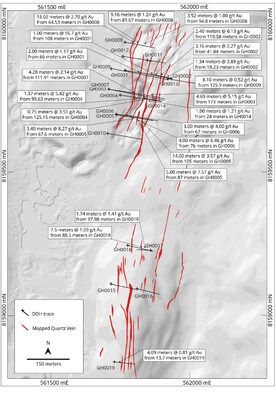

In 2022, the Company completed the next phase of its targeted approach with a maiden 21 hole diamond drill program totaling 3,010 m at Golden Hill, of which 14 drill holes totaling 2,405m were drilled at La Escarcha. Results from the maiden program at La Escarcha included:

- 3.57 g/t gold over 14.00 m (including 4.91 g/t gold over 8.80 m) from 105.0 m in GH0005.

- 8.27 g/t gold over 3.40 m (including 11.82 g/t gold over 2.02 m) from 67.60 m in GH0005.

- 7.57 g/t gold over 5.00 m (including 10.16 g/t gold over 3.66 m) from 87.00 m in GH0005.

- 2.70 g/t gold over 15.02 m (including 8.47 g/t gold over 3.10 m) from 64.53 m in GH0008.

- 6.46 g/t gold over 4.0 m (including 12.73 g/t gold over 2.00 m) from 76.00 m in GH0006.

See news release dated January 12, 2023 for complete results from the maiden drill program.

The maiden drill program demonstrated the presence of high-grade gold mineralized shoots within broader gold mineralized halos which define gold mineralized shear zones — typical of peer group deposits worldwide. Figure 1 sets out the results of the diamond drill program at La Escarcha and Gabby.

As a final step in the Company's initial exploration plan, a detailed petrographic study was carried out on the drill core. The petrographic study noted the absence of near-surface supergene enrichment and confirmed the gold grades are primary or hypogene.

Dr Wilson comments, "understanding that gold grades intercepted in the maiden drill program are primary or hypogene in nature, allows the technical team to confidently plan high-reward step-back holes to target the immediate depth extensions of the maiden Mineral Resource at La Escarcha. It also bodes extremely well for much deeper exploration (>500 vertical metres) in the future. Petrology has demonstrated that gold mineralization is similar to peer systems worldwide".

Mantaro allocated 14 drill holes of the 21 hole 3,010 m maiden diamond drill program to test a small "panel" beneath the La Escarcha open pit. Drill holes were completed in a series of "fences" over a strike length of only 400 m to vertical depths of generally less than 90 m. Mineralization is open in all directions at La Escarcha and the Maiden Mineral Resource Estimate is proof of concept. In addition there are multiple high reward targets beneath surface quartz veins and a larger untested regional trend. Specifically:

- High reward step-back and step-out drilling around the maiden resource at La Escarcha is a priority. Mantaro is presently designing a 5,000 m Phase 2 angled diamond drill program to test the along strike extension and deeper extension of mineralization to depths of approximately 300 m vertical. The depth potential below 300 m is extremely robust and will be the focus of subsequent drill programs.

- Five scout diamond drill holes were completed at Gabby (for 473 m). Gabby is located approximately 500 m to the south of La Escarcha and is characterized by a number of gold-bearing quartz veins in outcrop. The veins extend a further two kilometres to the brownfield target (Figure 2) where one drill hole was completed. There are over two kilometres of auriferous quartz veins approximately 500 m to the west of La Escarcha and Gabby which have only been tested by a single shallow drill hole. The exploration potential of Gabby, Brownfields and Westfield is extremely robust and warrants significant further drilling.

- In addition to the known prospects, there are over 6 km of unmapped regional structures that have shed alluvial gold into drainages either side. Significantly, the main controlling structure runs northwards from La Escarcha, before hosting the Puqui Norte deposit one km to the north of the concession boundary. The exploration potential of this structure is robust and will be the near-term focus of mapping and sampling by Mantaro.

Since Golden Hill is a permitted mining concession, the Company is able to commence these activities without the need of further permits.

The maiden Mineral Resource Estimate at La Escarcha has provided a foundational framework on which to scope mining optionality through the commencement of a Preliminary Economic Assessment ("PEA"). Mantaro will provide an update on its plans for a PEA in due course. Significantly, a number of input parameters for a PEA have already been completed.

The Company has data from previous underground mining for input into geotechnical and hydrological studies; bench-scale metallurgy has been completed on a meaningful underground bulk sample and demonstrates robust metallurgical recoveries and optionality of flow path; petrology has defined the physical characteristics and deportment of native gold and confirms it amenability to both gravity and cyanide recovery; petrology has demonstrated that deleterious minerals are not an issue, that the system is overall sulphide poor and that abundant carbonate minerals in waste rock are acid neutralizing.

The fact that Golden Hill is a permitted mining concession will significantly shorten the timeline to completion of a PEA.

The Mineral Resource Estimate was generated using inverse distance cubed for gold for grade interpolation within a 3-D model, constrained by mineralized zones defined by wireframes solid models. The bulk density values used in the Mineral Resource Estimate were derived from a regression equation based on data measured from samples collected from re-assayed drill core completed by the Company.

The database for the Mineral Resource Estimate consisted of 14 drill holes totaling 2,405m.

The contents of this news release have been reviewed and approved by Chris Wilson, B.Sc. (Hons), PhD, FAusIMM (CP), FSEG, a geological consultant of Mantaro, and by Eugene Puritch, P.Eng, FEC, CET, President of P&E Mining Consultants Inc., who is independent of the Company. Dr. Wilson and Mr. Puritch are Qualified Persons as defined by NI 43-101. Dr. Wilson is the Qualified Person for all technical information in this news release, excluding the Mineral Resource Estimate.

Mantaro Precious Metals Corp. is a British Columbia company that holds a diversified portfolio of gold and silver focused mineral properties in Bolivia and Peru. The Company holds an option to acquire up to an 80% interest in the advanced Golden Hill orogenic gold property ("Golden Hill"), located in the underexplored Precambrian Shield, Bolivia. Mantaro announced an Inferred Mineral Resource Estimate at Golden Hill of 857,000 tonnes at 4.4 g/t gold for 121,000 ounces of gold at a 1.5 g/t gold cut-off.

In Peru, the Company has a 100% interest in the high-grade Santas Gloria silver property.

Information set forth in this news release contains forward-looking statements that are based on assumptions as of the date of this news release. These statements reflect management's current estimates, beliefs, intentions and expectations. They are not guarantees of future performance. The Company cautions that all forward-looking statements are inherently uncertain and that actual performance may be affected by a number of material factors, many of which are beyond the Company's control. Such factors include, among other things: risks and uncertainties relating to Company's limited operating history, the requirement to raise additional financing to meet its obligations under its option agreement to acquire the Golden Hill Property and commence additional drilling activities and a preliminary economic assessment at Golden Hill, the success of future exploration and drilling activities at the Golden Hill Property and Santas Gloria Property, and the need to comply with environmental and governmental regulations. Accordingly, actual and future events, conditions and results may differ materially from the estimates, beliefs, intentions and expectations expressed or implied in the forward-looking information. Except as required under applicable securities legislation, the Company undertakes no obligation to publicly update or revise forward-looking information.

The forward-looking statements contained in this news release are made as of the date of this news release. Except as required by law, the Company disclaims any intention and assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE Mantaro Precious Metals Corp.